McKinsey & Company, a global management consulting firm, recommends that its clients evaluate the total cost of offshoring to determine if current economic conditions warrant bringing some manufacturing back to the States. See our blogs “Boeing 787 Dreamliner Illustrates the Dangers of Offshoring” and “GE, NCR Lead “Reshoring” Trend” for more perspectives on this issue.

——————————————————————————————————–

Time to Rethink Offshoring?

Changing economic conditions may have undermined some of the benefits of offshoring. For managers of global supply chains, this could be the time to reevaluate.

September 2008 • Ajay Goel, Nazgol Moussavi, and Vats N. Srivatsan

Retrieved March 15, 2012 https://www.mckinseyquarterly.com/Time_to_rethink_offshoring_2190

Source: Business Technology Office

The production of high-tech goods has moved steadily from the United States to Asia over the last decade. The reasons are familiar: lower wages, a stable global economy, and rapidly growing local markets. These factors combined to make nations such as China and Malaysia favored manufacturing locations. In the last two years, however, the favorable economic winds that carried offshoring forward have turned turbulent. The new conditions are undermining some of the factors that made manufacturers of every stripe, including those in high tech, move production offshore.

For executives managing global supply networks, the question now is whether or not conditions are moving toward a tipping point. Is this the moment to consider sharply scaling back offshore production plans and bringing manufacturing back or close to the United States? Is there a more measured response that better suits the new circumstances? Before executives change their strategies, however, they must determine the total landed cost of each product produced offshore and better understand the shifting trade-offs between cost savings from offshoring (such as lower wages) and rising logistics charges.

Oil prices, and consequently the cost of shipping, have risen to heights few foresaw even just several years ago. Since 2003, crude oil has soared from $28 to more than $100 a barrel. The economics research institution CIBC World Markets estimates that in 2000, when oil prices were near $20 a barrel, the costs embedded in shipping were equivalent to a 3 percent tariff on imports. Today, that figure is 11 percent—meaning that the cost of shipping a standard 40-foot container has tripled since 2000.

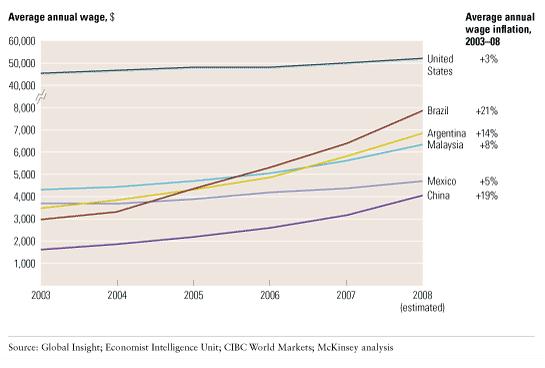

The oil spike not only affects exports from Asia but also sharply increases the price its manufacturers pay for raw materials. It now costs about $100 to ship a ton of iron from Brazil to China—more than the cost of the mineral itself. Wage inflation, coupled with a weaker dollar, adds to the challenge: in dollar terms, annual wage inflation in China has averaged 19 percent since 2003 (Exhibit 1). An average production worker, paid $1,740 a year in 2003, makes $4,140 today. By contrast, wage inflation in the United States has averaged only 3 percent. The wage differential between Mexico and China has also narrowed significantly. In 2003, Mexican workers made over twice what their Chinese counterparts did; today that gap has narrowed to 1.15 times. Combined, these trends are reshaping the competitive landscape for offshore manufacturing in a number of locales.

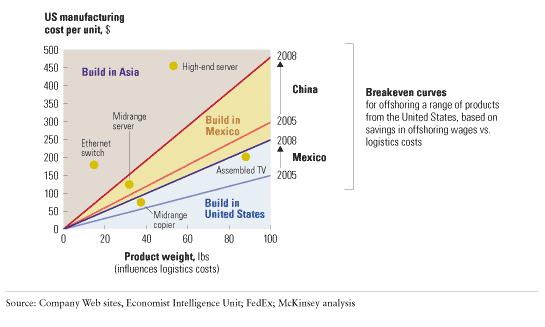

To develop a clearer picture of the changing environment, we analyzed a number of products manufactured for the US market and mapped the optimal region to manufacture them by straightforwardly comparing the wage savings from offshoring with the cost of logistics. Exhibit 2 shows the optimal regions for products with a range of different unit manufacturing costs (all related to the transformation of raw materials into one unit of finished goods in US dollars) and various product weights (which affect logistics costs). We have chosen breakeven curves for China, a traditional low-cost manufacturing location, and for Mexico, a near-shore location.1

However, these curves are shifting amid the economic dislocations. Products that were once profitably made in areas where the local costs are lowest (dark-gray area) are therefore moving into the near-shoring zone (light-gray area)—or in some cases may now be suitable for production in the United States (blue area). A midrange server, for example, made profitably in China three years ago, has slipped below the breakeven line because of higher wages and freight costs. The server now could be produced more economically at a plant closer to consumers (in Mexico, for example, where the mix of logistics and labor costs is more favorable).

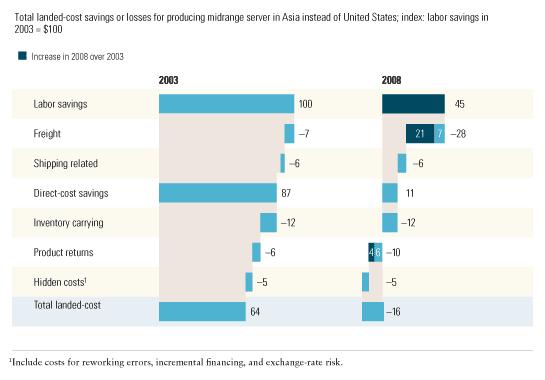

To estimate the trade-offs more precisely, supply chain managers also need a true picture of landed costs. These include the cost of raw materials, carrying inventory, managing product returns, and other hidden charges2 not typically considered in the simple trade-off between offshore wages and logistics described previously.

As an illustration, we studied the total landed cost for a midrange server, comparing scenarios in Asia and the United States (Exhibit 3). Five years ago, in 2003, manufacturing this product in Asia rather than the United States provided a 60 percent savings in labor costs. We have indexed that labor savings to $100. When we calculated total landed costs, however, we found that 36 percent of those labor savings were offset by freight, shipping-related charges, inventory, product returns, and other hidden costs. That gave Asian production a $64 landed-cost advantage. Today, economic conditions have reversed it. After factoring in the higher labor and freight costs, we find that the former offshore savings have turned negative—a burden of an extra $16. The labor savings, $100 in 2003, are now only $45 because of wage inflation. In addition, freight costs have risen by $21 and product returns by an additional $4 because of higher oil prices.

As these examples suggest, changing economic conditions may have undermined your supply chain advantage. This may be an appropriate moment to reevaluate the location of your manufacturing facilities. Take the total landed-cost analysis to the next level of detail and determine if bringing some production back home or to near-shore locations will help counterbalance the higher costs of shipping and freight. At the same time, consider the long-term geographic distribution of demand for your products. In rethinking your global supply chain, you must carefully evaluate the importance of speed, the availability of skilled talent, the potential for further productivity gains in Asia, one-time transition costs, the local import and tax implications, and organizational interfaces.

About the Authors

Ajay Goel and Nazgol Moussavi are consultants and Vats Srivatsan is a principal in McKinsey’s Silicon Valley office.

Notes

1 Exhibit 2 shows, for example, that the total cost of manufacturing a 60-pound high-tech product would have to be at least $260 to counterbalance the higher logistics costs of producing in Asia.

2 Hidden costs include reworking errors, incremental financing, and exchange-rate risk.

© Copyright 1992-2012 McKinsey & Company